Portfolio Value Overview

Track, measure and compare the valuation of your portfolio

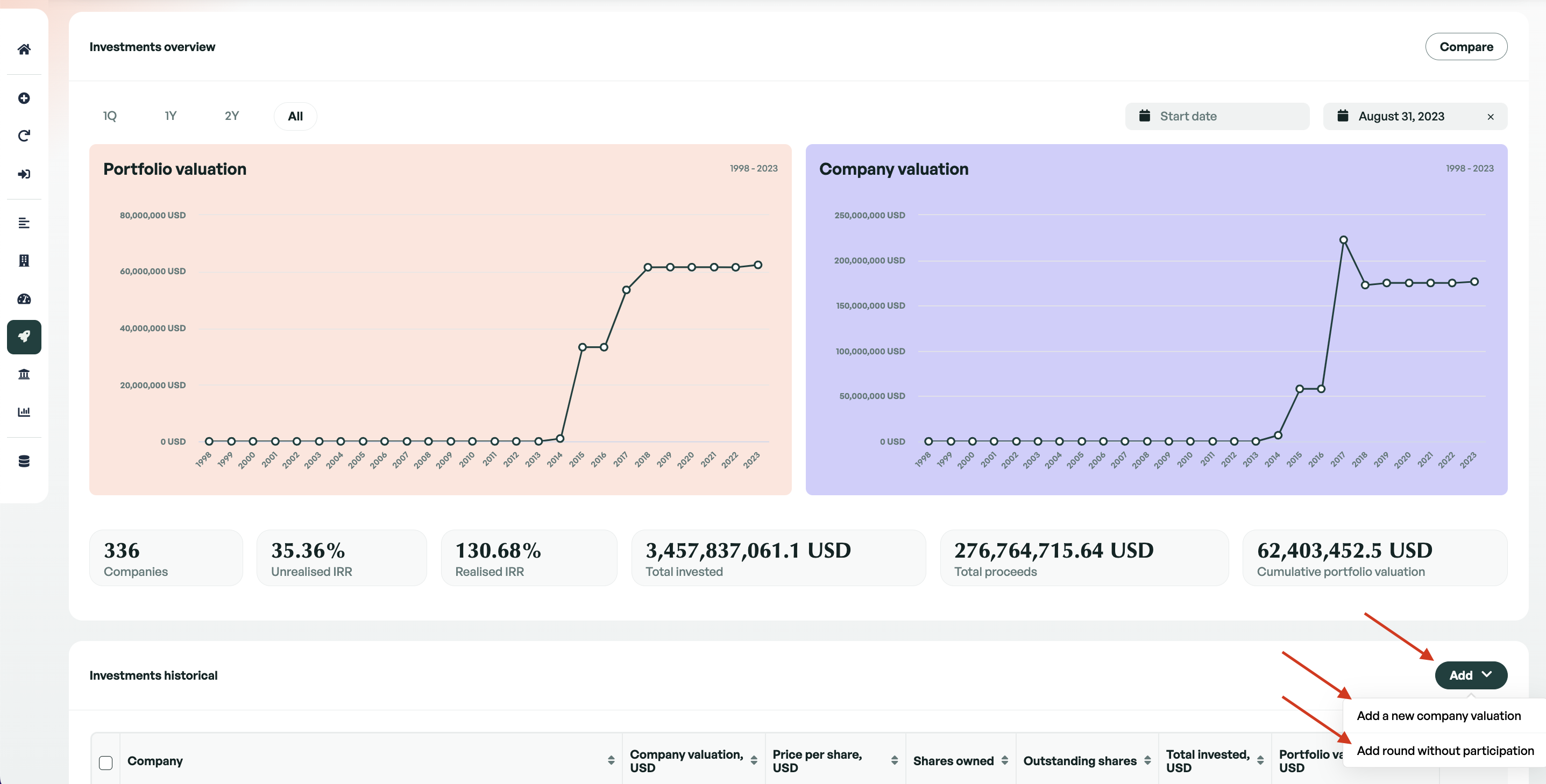

Portfolio Value is the place to track the valuations of all the companies within your portfolio. Keep track of your fund's IRR, Proceeds, Investments and Valuations. Compare companies either individually or grouped by categories using the easy-to-use filters and receive insights on key indicators.

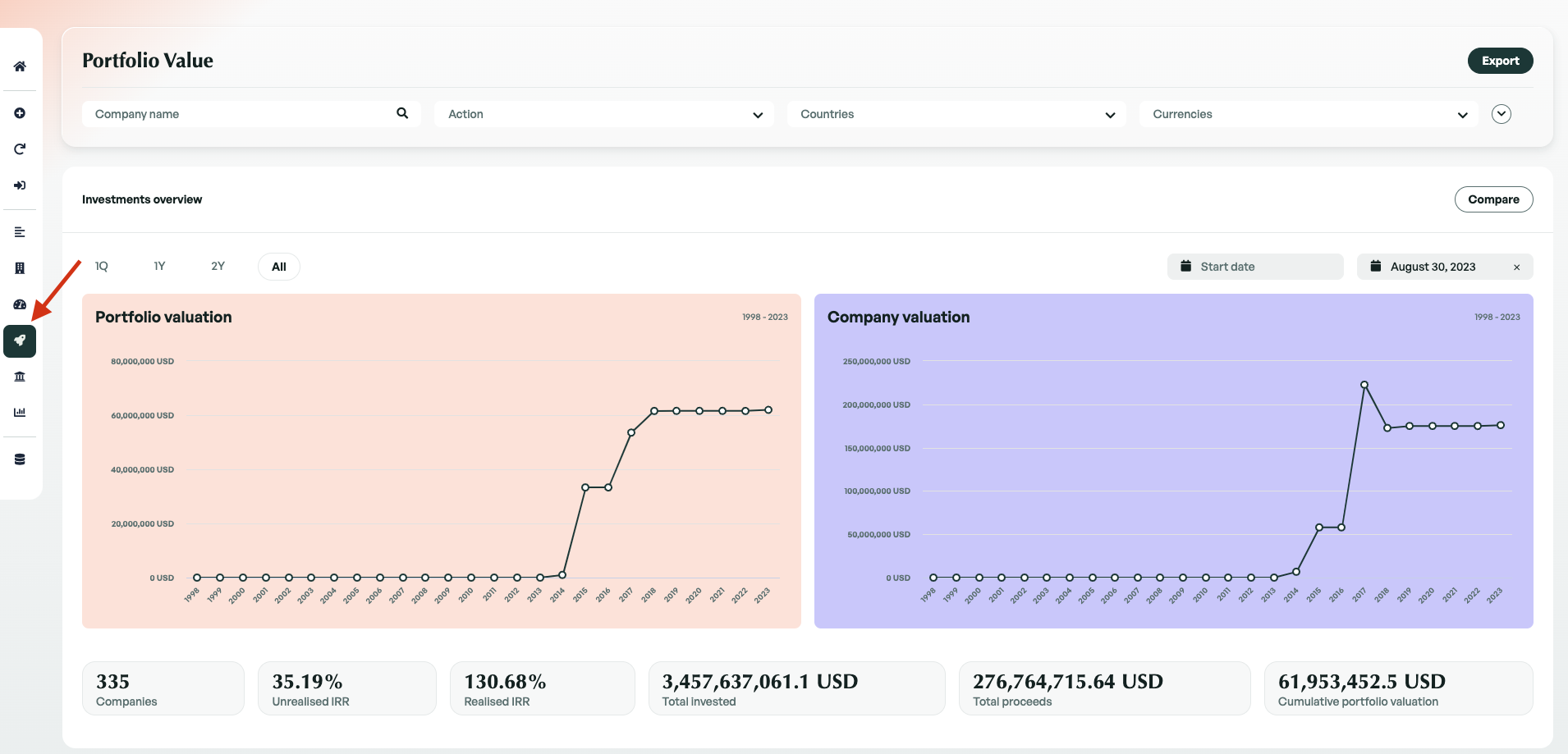

Accessing Portfolio Value

Portfolio Value can be accessed through the Portfolio Value button from the side navigation menu.

-

Portfolio valuation: This is the valuation of your investments.

-

Company valuation: This is the total valuation of one or more companies, including rounds without participation.

Comparing company valuations

When you first enter the Portfolio Value, the graph presented is representative of all the companies within the fund you are viewing. On the right of the graph is a breakdown of key statistics, these are Realised/Unrealised IRR, Total companies, Total invested, Total Proceeds and Cumulative Valuation.

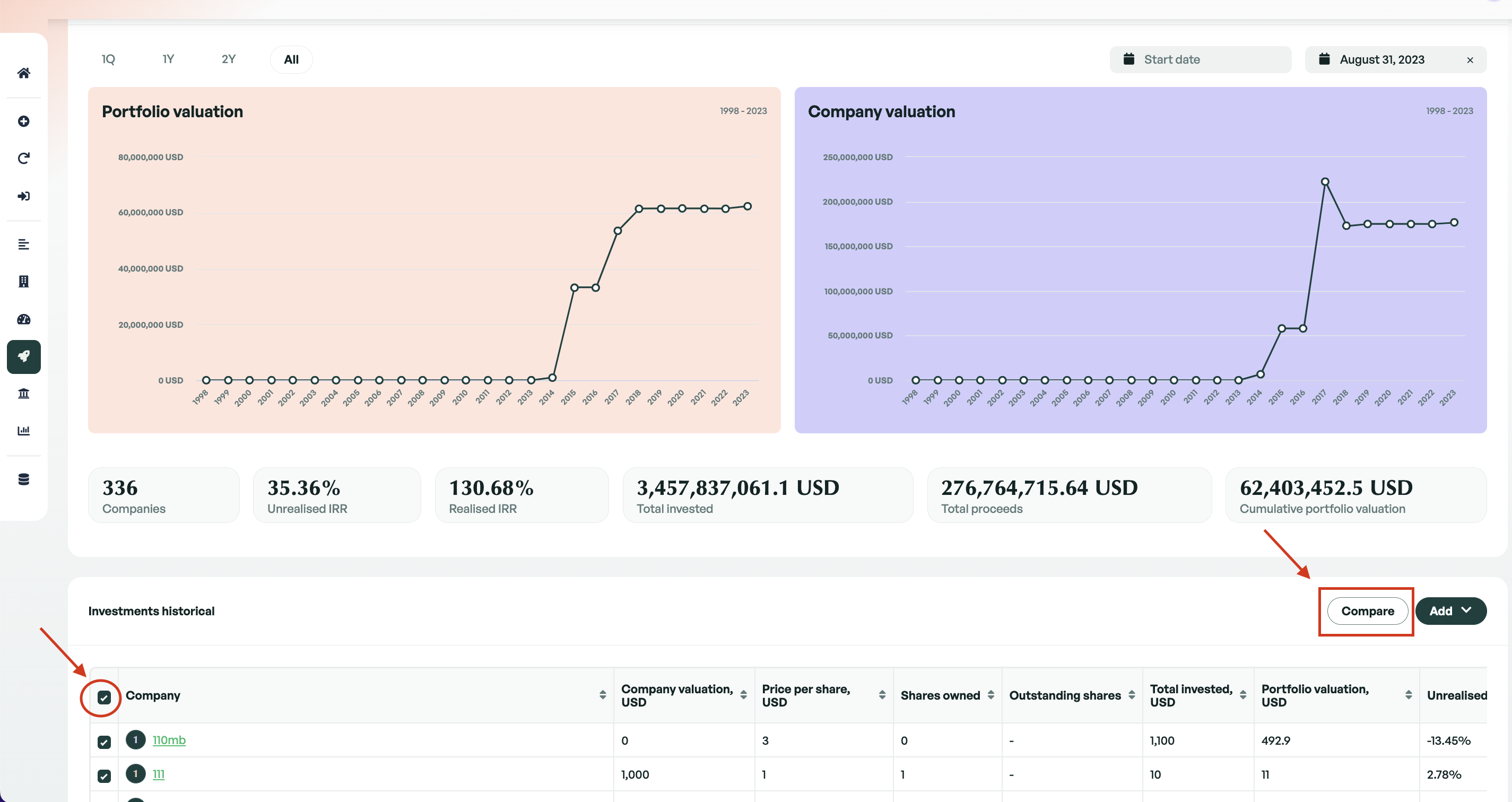

To add additional companies to this graph, you can either select companies from within the 'add to compare' dropdown menu or you can select companies by clicking the checkboxes and selecting the 'compare' box that appears. Once you have chosen to compare companies, you are provided with the choice to either add them individually or group them together.

Once you have added companies to the graph, all key statistics will be updated to reflect the current companies being compared

You can click on the single or grouped companies to hide them from comparison or remove them by clicking on the x next to the name.

Modifying the temporality of the graph

When you add companies to be compared, Edda will automatically generate a timeline for your graph starting from the earliest investment year within the companies being compared. The default timeline of the graph is by year, although this can be changed to either Quarterly, Monthly or Weekly by choosing the temporality of the graph. If you would like to compare a certain date if the past, you can actively select the date from the provided calendar.

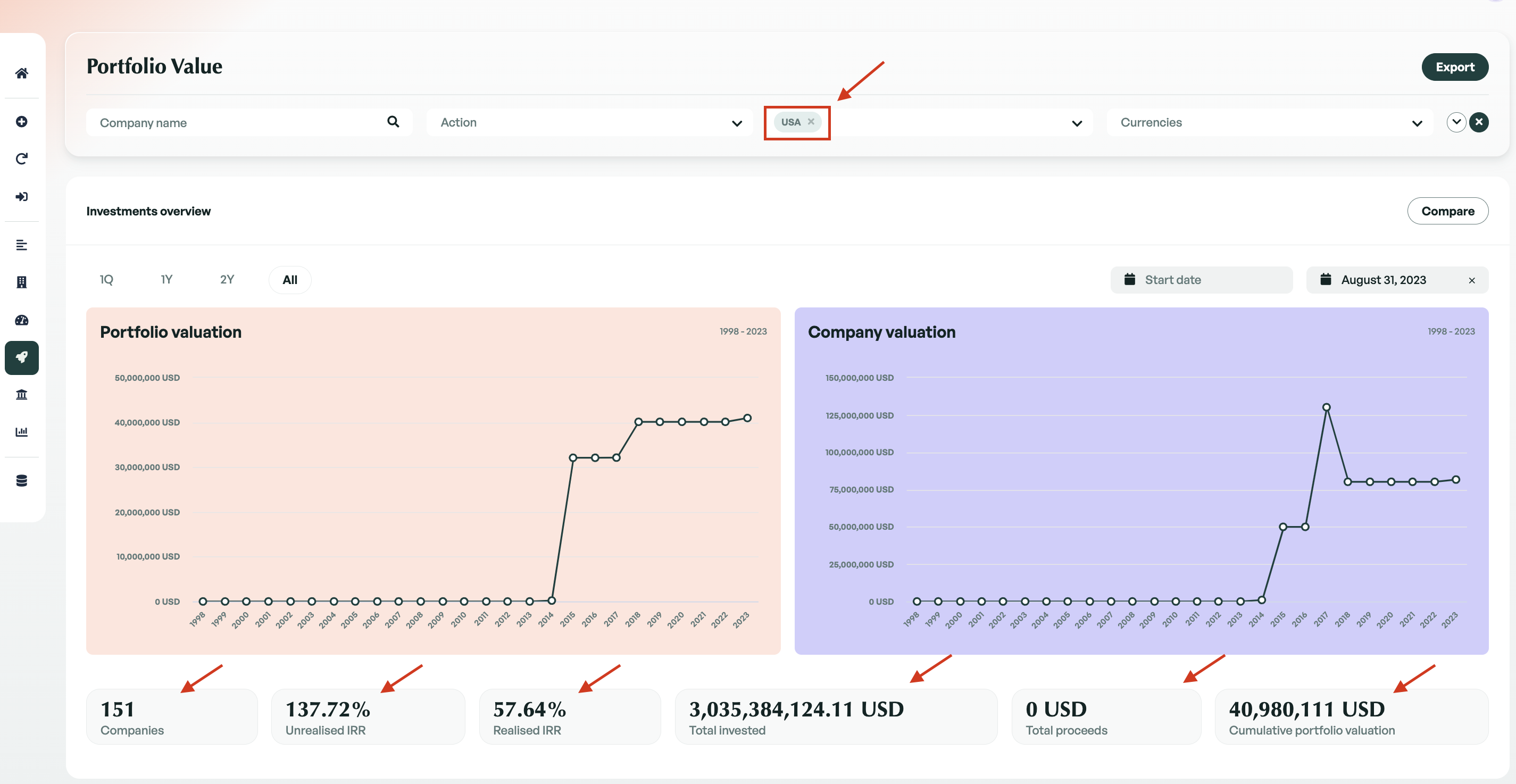

Utilising Filters

The filters in portfolio value provide you with the ability to quickly filter companies in your fund. With the filters provided, you can filter to find companies by name, action, industry, country, lead and other options.

Example: if you want to find the IRR for all your companies based in the USA, you can set the country filter to USA and the IRR and all metrics will be updated automatically.

You can also select the checkbox next to 'Company' in the 'Investments historical' section and click 'Compare.' You can then choose to add the companies as a group. The graph will now update to display all the key statistics for this group of companies.

Individual Company Valuations

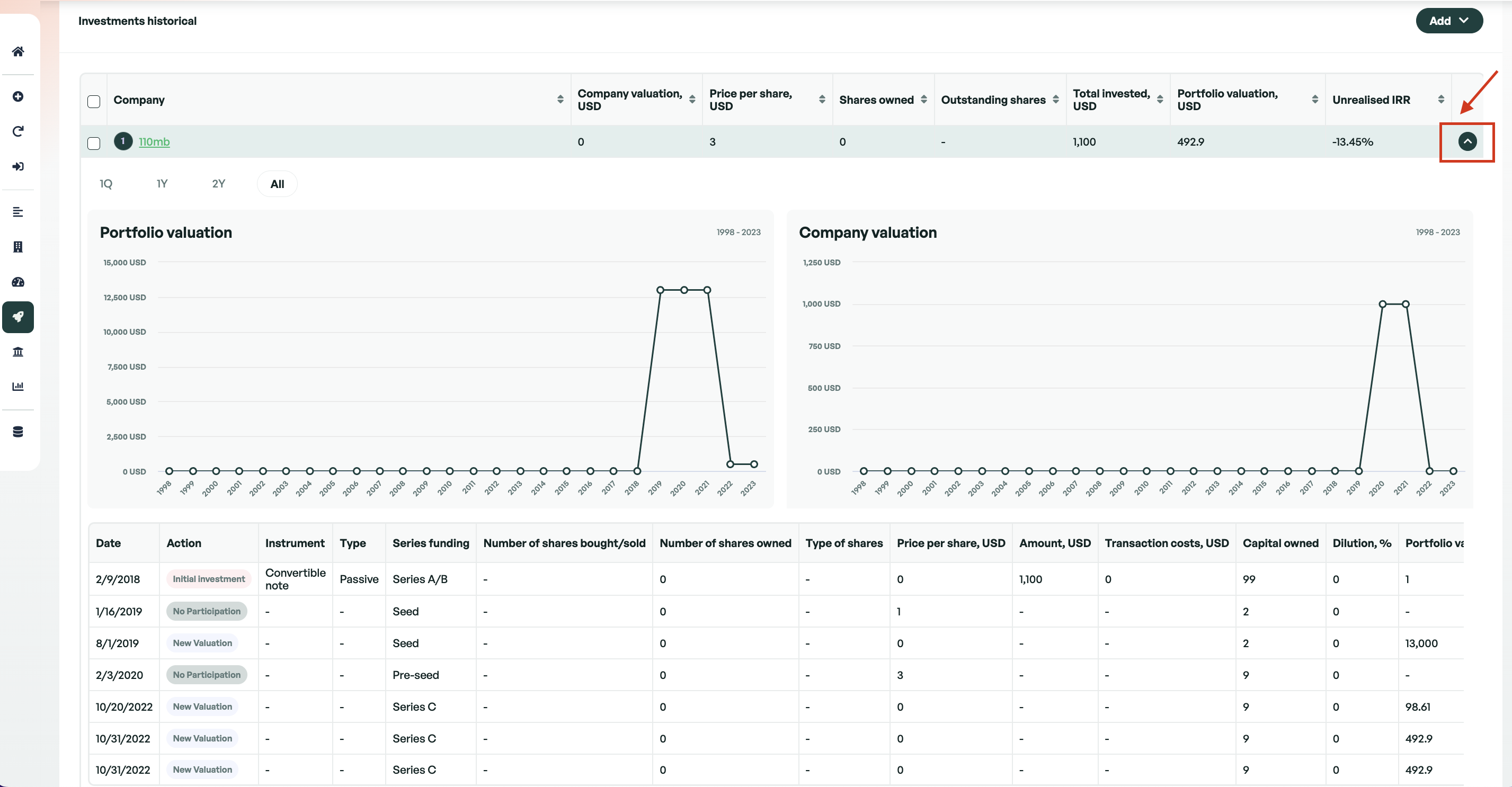

Portfolio value contains valuations of all the companies within your fund. For each company, you can expand the view to be able to view both a history of the company's valuation since being added to your fund and also a company-specific graph.

Note: The company valuation is the post-money valuation.

Updating Company Valuation or Adding Round Without Participation.

In the 'Investments historical' section, click the 'Add' button to access two options:

-

Add a new company valuation

-

Add round without participation

If there is anything you need further information assistance with? Please contact our support team on the platform, we are always happy to provide assistance.