A guide on how LP and Partner pipelines differ

![]()

Within Dealflow, as well as the company pipeline, you have the option to create and utilise an LP or Partners pipeline. In this article, I will provide a quick overview of the different pipelines.

What is an LP and Partner Pipeline?

An LP pipeline is used to track and qualify potential LP's/investors within your fund.

A partners pipeline was created for networking purposes. Its purpose is to provide the ability to add partners' funds to invest with, to have the list of other funds you are working with, to push their deals and build projects with them.

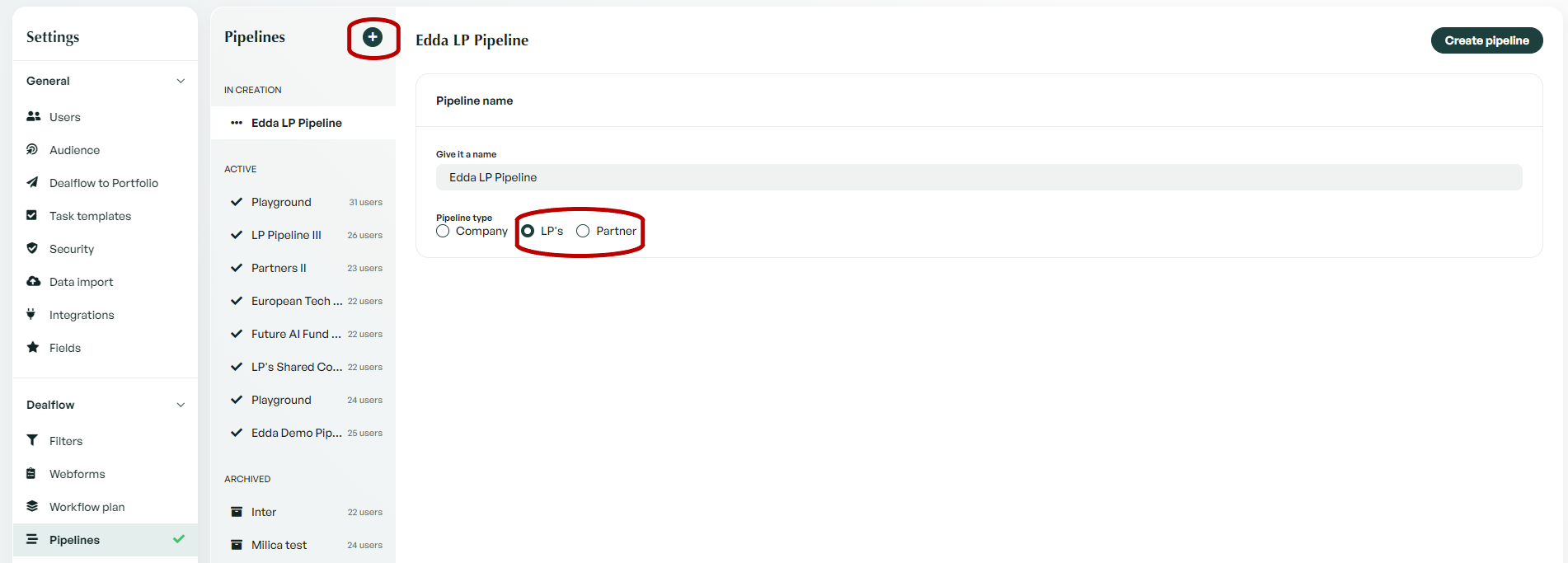

How do you create a new pipeline?

You can create a new LP or Partner pipeline from the pipeline menu within the navigation menu. When creating a new pipeline, Administrators will be automatically added to the new pipeline.

What are the differences between these pipelines?

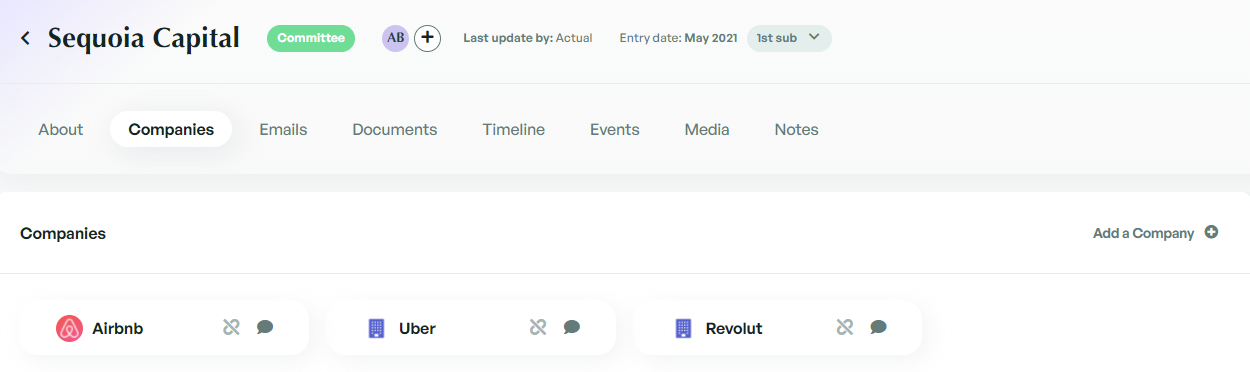

There are a few differences between these pipelines and a company's pipeline. The main difference is within an individual LP or Partners profile. Within the profile, there is a tab named 'companies'. This tab provides an overview of all the companies to which this specific LP or Partner has been attached within your company's pipeline. There are also a few differences in the default fields and stage names in each pipeline.

If there is anything you need further assistance with, please contact our support team on the platform, we are always happy to assist.